by Dr. Chris Kacher

Riding the Revolutionary Rocket with Cryptotechnologies... Entirely Evolutionary™

Premarket PulseBefore I get into discussions on blockchain, regulation, and big government, the jobs report came in at just 75,000 new jobs vs. estimates of 185,000. Markets initially sold off then rallied for two reasons. First, this will put more pressure on the Federal Reserve to cut interest rates, and second, the U.S. has decided to give some Chinese products additional time to avoid a tariff hike. The unemployment rate remained at a 49-year low of 3.6%. Of course, this is largely due to the number of low paying temp jobs that are included in the tally as well as the number of people who have given up looking for work that are not included in the tally.

Last Monday, tech stocks with some of the largest capitalizations got clocked as antitrust investigations were announced against several large tech companies. The Justice Department is gearing up for an antitrust investigation into Alphabet Inc.’s GOOG and AAPL while the Federal Trade Commission now reportedly has oversight to look into anti-competitive activities of Facebook and Amazon.

Then on Tuesday, with the ongoing theme of QEndless, Australia’s central bank cut rates for the first time in 3 years. The Reserve Bank of Australia lowered its benchmark interest rate by a quarter of a percentage point to 1.25%. Some economists say the rate could go as low as 0.5% by the middle of next year.

In an accompanying statement, RBA Gov. Philip Lowe said the risks from trade disputes have increased. “Growth in international trade remains weak and the increased uncertainty is affecting investment intentions in a number of countries,” he added.

St. Louis Fed president James Bullard notably chimed in that the U.S. Federal Reserve may have to cut interest rates soon because of low inflation and the threat to the economy from the accelerating trade wars with other countries. The news comes as no surprise. We first spoke of this coming to pass at some point in 2019 in December 2018.

Indeed, renowned investor Stanley Druckenmiller sold his 93% exposure in stocks on Tuesday and switched to bonds, anticipating the Fed may have to lower rates all the way to zero percent. “When the Trump tweet went out, I went from 93% invested to net flat and bought a bunch of Treasurys,” Druckenmiller told Scott Bessent, founder and chief investment officer of Key Square Capital Management at the Economic Club of New York. You can watch the full interview with Druckenmiller

here.

Separation of State and Economics

Humanity was able to see the logic behind keeping government out of religion, thus the separation of church and state was born. We may be on the brink of something massive in terms of greatly reducing government's control over financial affairs. Granted, this requires many mental dots one must connect to see how this could even be possible. But just because something has never happened before, and just because governments -totalitarian, democratic, and every form of government in between- have always controlled money flow does not mean things cannot change in a revolutionary way. If you look at the human timeline, we are experiencing a parabolic rise in technology. This technology brings far greater freedoms than anyone could have imagined a few hundred years ago let alone 50 years ago. And the parabolic rise just gets steeper the further along the timeline we move. In other words, the future looks bright. Big change will be here before we know it.

Advantage: S-Curve

Most underestimate exponential S-curve technologies simply because they start small then get big fast. If you double a number, it's unnoticeable the first several times it doubles, but by the time you've doubled it at least 15-20 times, it's significant and by the 30th double, it's massive. Blockchain, AI, VR, and other such game changing technologies all trace exponential growth curves.

Blockchain is the first technology in the history of humanity that will help decentralize human beings.

An article on why ants are the most successful species: they are decentralized and blockchain is the first tech of its kind that will help bring humanity into a more decentralized form. Many cooperating create superior results - none of us is as smart as all of us. From decentralized oracles to decentralized file sharing to decentralized CPU sharing, the limits are one's imagination.

Decentralized Tech

Examples abound. A good friend of mine who is the CEO of

rLoop won Elon Musk's competition by building an army of decentralized engineers around the planet. These engineers were not even paid though going forward, they will be compensated. They are building structures that triumph over existing ones. Global, crowdsourced engineering.

But that they were willing to do the work without payment is equivalent to the exponential growth of wikipedia. These are unpaid volunteers who contribute to the encyclopedia. Sure, it has its growing pains but now is one of the most up-to-date platforms of knowledge on the internet. That said, it's not perfect and trench warfare wiki 'gangs' can end up manipulating entries for unknown purposes, but it is certainly better than the 'old school' ways.

One of the oldest examples of decentralization is peer-to-peer (p2p) file sharing which remains untouchable by governments despite their vain attempts to quash it since the days of Napster in the mid-1990s. For every Pirates Bay that is ended, 10 new ones come online.

Banning Bitcoin

The same will be true of bitcoin. China has tried in vain to ban various aspects of bitcoin technology from trading it to mining it. Chinese investors just move their bitcoin to an exchange outside of China. They have also used bitcoin to move big money outside of China, far exceeding the $50,000 equivalent in yuan maximum allowed by the Chinese government. When they made ICOs illegal in China, companies just moved to Hong Kong or the equivalent.

The recent rise in the price of bitcoin from the low $3000s to roughly $9000 before breaking its upside parabolic move is due in part to the trade war between the U.S. and China. It is feared that Chinese companies will suffer weakening profitability which could force Beijing to depreciate the Chinese yuan to absorb the shock of U.S. tariffs. Guo Shuqing, China's top banking regulator warned against short-selling the yuan saying short sellers would "inevitably suffer a huge loss." Famed and legendary investor Jim Rogers said he typically shorts the currency in question in such situations. He says that proclamations by government officials and the like are meaningless.

Thus a number of Chinese may be moving some of their capital from the yuan into offshore bitcoin platforms.

India is considering prison terms for anyone caught with bitcoin and potentially other forms of cryptocurrencies. The Venezuelan government has already done this. But such draconian measures will hamper growth while other more forward thinking countries embrace the technology to gain the advantage.

TLDR: Government can try to ban new tech all they want, but governments are always the slow animal in humanity's 'herd' so there will always be ways to override government control and corruption. In Venezuela, millions of families have used bitcoin to move their depreciating savings into bitcoin then into a stable fiat currency. Dash which is a privacy coin is the override to bitcoin being illegal in Venezuela. The Venezuelan government remains mostly clueless to this.

SEC vs. Blockchain

Over in the U.S., the renowned venture capital genius Fed Wilson among others has tweeted that should the SEC take too heavy handed an approach to regulations concerning blockchain, companies will simply move out of the U.S. This already happened when the state of New York passed the onerous Bit License requirement a few years back. Compliance costs were so steep that most all smaller companies had to move outside of New York, with most moving out of the U.S.

Fiat's Days Numbered?

But while the dollar, euro, and pound remain the pillars of stability when it comes to currencies, the planet is mired in record levels of debt with interest rates in many countries at all-time lows. What does this say about fiat which is backed by the full faith and credit of the underlying government? As QE-Infinity continues with no end in sight, a massive monetary shift is already starting to occur.

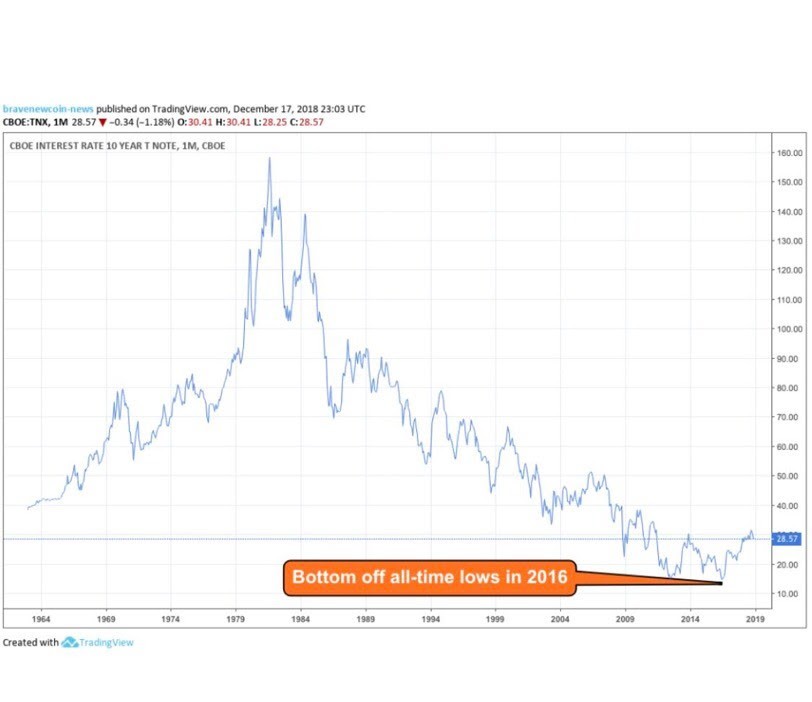

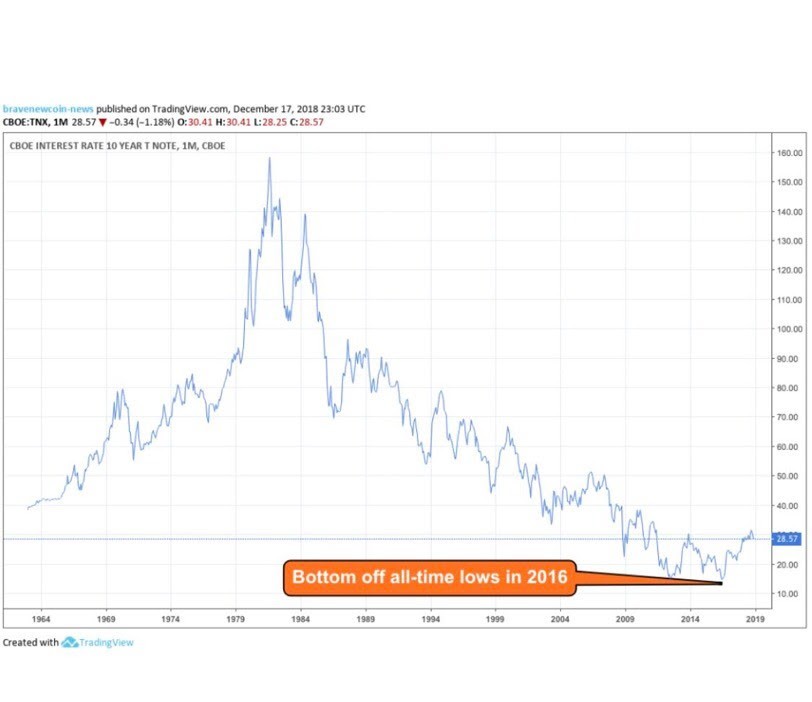

While the Fed hiked rates several times by 25 basis points each time over the last few years, rates in the U.S. still remained near historical lows since they started from historically low levels. Now with the world teetering on recession, the Fed is faced with having to undo these mini rate hikes. Indeed, the ability of central banks to spur economic growth through monetary policy has diminished considerably over the last few debt cycles. Note in the graph below how the yield on the 10 year has been on a downtrend since it peaked in the early 1980s. Also note the slight uptrend in rates over the last few years as the Fed became increasingly hawkish by hiking rates.

When the Fed attempted to get even more hawkish in the later part of 2018 with little end in sight to their bank balance reductions, major stock markets in the U.S. finally gave up the ghost by collapsing by roughly -20% in December 2018. It was the first Christmas crash in U.S. stock market history. Fed Chairperson Powell then was forced to make the proclamation that he would halt balance sheet reductions and do what it takes to keep the bull market alive.

That was on December 15 and marked the low of the correction which spurred a sharp uptrend up until recently.

Enter the Trade Wars

Since then, the trade wars together with the slowing global economy have taken their toll sending U.S. markets below their respective 200-day moving averages, but just for an instant. President Donald Trump plays the Fed like a fiddle, knowing he can maintain a tough stance on trade as the Fed will simply monetize more debt should conditions deteriorate. Indeed, the Fed’s Powell gave the nod to multiple rate reductions if necessary in the coming months.

In any event, when the next recession hits, the deflationary forces of automation and technology that continue to accelerate, part of the 6 D’s of Peter Diamandis, will replace a growing number of jobs which in turn will further reduce consumer demand. In other words, the next recession will likely be one for the history books though exponential growth technologies will be the counterbalance thus the parabolic rise will continue on relentlessly.

(͡:B ͜ʖ ͡:B)

This information is provided by MoKa Investors, LLC DBA Virtue of Selfish Investing (VoSI) is issued solely for informational purposes and does not constitute an offer to sell or a solicitation of an offer to buy securities. Information contained herein is based on sources which we believe to be reliable but is not guaranteed by us as being accurate and does not purport to be a complete statement or summary of available data. VoSI reports are intended to alert VoSI members to technical developments in certain securities that may or may not be actionable, only, and are not intended as recommendations. Past performance is not a guarantee, nor is it necessarily indicative, of future results. Opinions expressed herein are statements of our judgment as of the publication date and are subject to change without notice. Entities including but not limited to VoSI, its members, officers, directors, employees, customers, agents, and affiliates may have a position, long or short, in the securities referred to herein, and/or other related securities, and may increase or decrease such position or take a contra position. Additional information is available upon written request. This publication is for clients of Virtue of Selfish Investing. Reproduction without written permission is strictly prohibited and will be prosecuted to the full extent of the law. ©2026 MoKa Investors, LLC DBA Virtue of Selfish Investing. All rights reserved.