Major markets are in very sharp oversold rallies as bearish sentiment and positioning was becoming evident last weekend. At that time, the National Association of Active Investment Managers Exposure Survey showed a net long exposure of 24.82% as of two Thursdays ago, and as of this past Thursday it had only risen to 29.17% as active money managers remain significantly net short. This has set the stage for a very sharp short-squeeze type of rally as active institutional investors, notable hedge funds, remain substantially offsides on the bearish side of the boat.

The NASDAQ Composite reflects the urgency with which shorts have had to cover following what was viewed as a relatively dovish Fed policy announcement and press conference on Wednesday and then a weak Bureau of Labor Statistics jobs report on Friday that came in with 150,000 new jobs. In addition, the report had an additional 412,000 jobs added to the count by a statistical fudge-factor known as the Birth-Death Model where the BLS assumes that thousands of new businesses have started and are adding jobs that do not get counted. In an environment where small business bankruptcies have been burgeoning, our tendency is to think this adjustment grossly distorts what otherwise would have been a net loss of 262,000 jobs.

The NASDAQ Composite reflects the urgency with which shorts have had to cover following what was viewed as a relatively dovish Fed policy announcement and press conference on Wednesday and then a weak Bureau of Labor Statistics jobs report on Friday that came in with 150,000 new jobs. In addition, the report had an additional 412,000 jobs added to the count by a statistical fudge-factor known as the Birth-Death Model where the BLS assumes that thousands of new businesses have started and are adding jobs that do not get counted. In an environment where small business bankruptcies have been burgeoning, our tendency is to think this adjustment grossly distorts what otherwise would have been a net loss of 262,000 jobs.The NASDAQ cleared its 50-day moving average on Friday on roughly flat volume as it now tests the upper boundary of its current downtrend channel. Technically, the index remains in a downtrend with lower lows and lower highs, but this could change this coming week. While the short side has been a good place to be in October, the near-term short-squeeze can make things treacherous for slow-moving shorts, as the participants in the NAAIM Exposure Survey shown above appear to be. The latest rally in the downtrend channel is far steeper and has greater velocity than the prior two that eventually failed, but is now in a position where the others failed. We would not, however, make any assumptions as any move through the early October peak would set up a higher high and could signal a more meaningful change of trend.

The sharpest rallies have been seen in big-stock NASDAQ techs which were some of the most heavily shorted names in the market among the mega-caps. Among names we have reported on earlier in October and which worked well as short-sale targets prior to this week's market bounce, Apple (AAPL) has rallied from a U&R that it posted last week ahead of earnings on Thursday of this past week. It sold off early on Friday but gained support from a strong general market rally to regain its 50-dma on a supporting pocket pivot signature. If it can hold the 50-dma it may play out as a long set-up using the line as a selling guide, whereas any break back below the 50-day would trigger a short-sale entry at that point.

Adobe (ADBE) has rallied sharply this past week but is now approaching the left-side peak of 574.40 where potential double-top resistance might come into play. Otherwise it is currently not in an actionable position, long or short. Amazon.com (AMZN) has rallied sharply this past week but is also not in an actionable position currently. Qualcomm (QCOM) posted a bottom-fishing buyable gap-up (BFBGU) after earnings on Thursday and was able to overcome 200-dma resistance on Friday. It is extended near-term but can be watched for any constructive action if it consolidates along what is now 200-dma support. If it reverses back below the 200-day line then a short-sale entry would be triggered.

Outside the mega-cap tech area, the patterns are less bullish among names we reported on as short-sale set-ups earlier in October. Agricultural machinery maker Agco (AGCO) has rallied 32 cents past its 50-dma on average volume. It can be watched for any reversal back below the 50-dma as a possible short-sale entry trigger. Confluence (CFLT) was reported on as a short-sale entry at the 50-dma three weeks ago and it blew up this past week after reporting earnings. It is, of course, extended on the downside.

MongoDB (MDB) remains in a short bear flag where the 20-dema has served as near-term resistance. So far it has failed to rally significantly with the market this past week. TJX Companies (TJX) finally rallied with the market on Thursday and Friday, but on Friday posted a double-top short-sale (DTSS) entry at the 91.18 left-side peak over over two weeks ago. That puts it in a DTSS entry position using the 91.18 level as a covering guide.

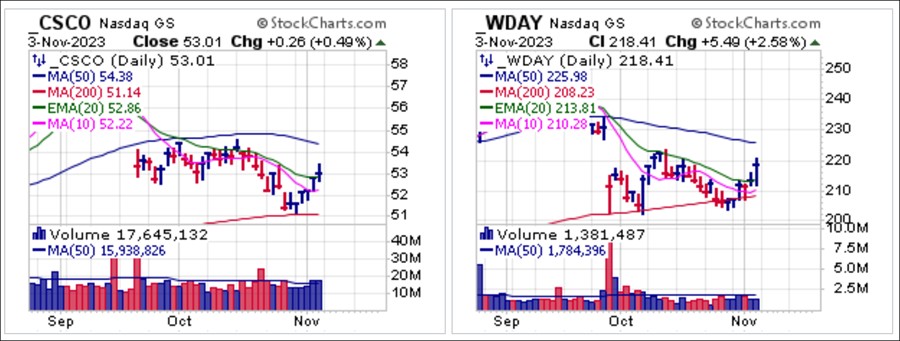

Other names we reported on as Short-Sale Set-Ups in the earlier part of October, Cisco Systems (CSCO) and Workday (WDAY) have rallied with the market, as might be expected, but so far the rallies have not carried the stocks significantly beyond current price ranges. Either could rally up to 50-dma resistance where they might morph back into short-sale targets, or reverse back below their 20-demas which would then trigger as short-sale entries, so all of this can be watched for.

The Market Direction Model (MDM) remains on a SELL signal. Due to a key change made to the model in Feb-2019, whipsaws were minimized as it has aimed since then to capture the major trends in the major averages. The straight up from bottom market action since Wednesday November 1 has been the result of Fed chair Powell's testimony on Wednesday, strong earnings overall, and productivity well above expectations reported on Friday.

The Market Direction Model (MDM) remains on a SELL signal. Due to a key change made to the model in Feb-2019, whipsaws were minimized as it has aimed since then to capture the major trends in the major averages. The straight up from bottom market action since Wednesday November 1 has been the result of Fed chair Powell's testimony on Wednesday, strong earnings overall, and productivity well above expectations reported on Friday. Markets interpreted his testimony as dovish even though he said that despite moderating inflation, rates would have to remain elevated to accomplish the 2% mandate. Nevertheless, he implied rate hikes are over though of course, this is always data dependent. Inflation in areas that people need the most including food, energy, transportation, and housing remains an issue so rates may need to stay elevated for longer than expected.

Friday's jobs report showed a cooling jobs market which implied rate reductions could come ahead of predictions. Unemployment rose to 3.9%, the highest since Jan-2022, from a low of 3.4% set earlier this year. This could be the start of an acceleration in unemployment in the coming months if history is any guide. CME FedWatch now expects the first rate reductions in May-2024. Keep in mind that history shows that the Fed tends to overshoot when it comes to interest rates which eventually breaks the economy forcing them to lower rates in a hurry. The first rate reduction is therefore typically the first in a string of fast rate reductions as stock markets enter into prolonged downtrends.